ESG

Overview

ESG Value

CLASSYS is dedicated to delivering customer-oriented and innovative products and solutions, enabling beauty and happiness for all.

We firmly believe that ESG values will help shaping CLASSYS’ sustainable future, and We are committed to exploring and implementing ways for the company and society to coexist and thrive together.

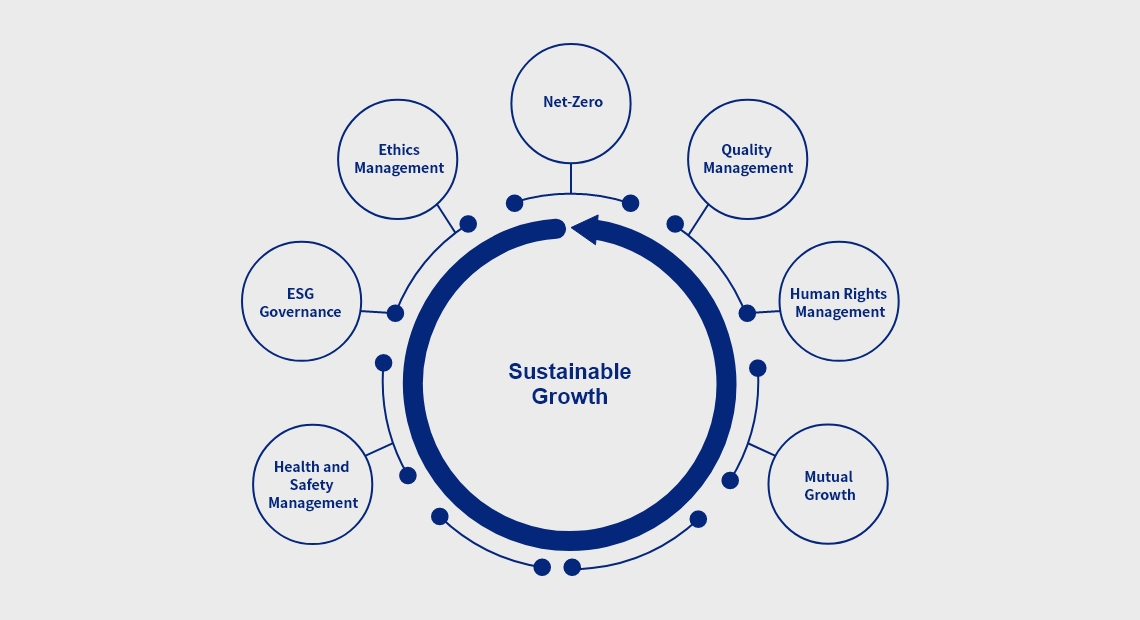

ESG Strategy

CLASSYS drives sustainable ESG value creation through stakeholder communication. Our transparent and professional governance, focused on ethical management, supports strategic initiatives like mutual growth, quality management, and carbon neutrality. Through cross-functional collaboration, we embody ESG values, keeping stakeholders informed of our sustainable progress and processes.

ESG Ratings

CLASSYS are committed to creating ESG value.

-

- KCGSB+

-

- SUSTINVESTA

-

- Recognized as an Excellent Company in Governance by KCGS

-

- SUSTINVESTAA

-

- KCGSB+

-

- MSCIBBB

-

- MSCIA

-

- KCGSA+

-

- SUSTINVESTAA

-

- Recognized as an Excellent Company in Governance by KCGS

ESG Report

CLASSYS Sustainability reportCLASSYS transparently reports on our actions to shape a sustainable future.

History

ESG Policy

We establish and implement policies for ESG value. We will communicate transparently with stakeholders about our progress and performance in accordance with these policies.

Environmental

Building Carbon Neutrality and Environmental Governance

Classys is committed to achieving carbon neutrality by 2050. To that end, we are driving a range of initiatives to reduce greenhouse gas emissions and build a robust governance system for carbon neutrality.

Our ESG strategies and performance are reviewed and approved by the Board of Directors, while a dedicated team is in charge of setting environmental goals, monitoring progress, and leading environmental campaigns.

In addition, our EHS (Environment, Health & Safety) team proactively monitors regulatory changes related to the environment and develops responsive action plans. Each department across the company works collaboratively to meet established environmental objectives.

The EHS team also monitors the execution of environmental initiatives, offers guidance when needed, and reports regularly to the CEO.

- Establishing Board oversight

- Dedicated EHS Team

- Regular screening of environmental and safety laws and regulations

- Energy and GHG inventory and monitoring

- Company-wide education and campaigns

- Additional KPIs for environmental indicators

- Linking performance evaluation to compensation

- Fostering a culture of embodying ESG

- Continuous performance analysis and improvement

Environmental Compliance

Classys regularly identifies EHS risks at business sites and within production processes, deriving key tasks for improvement. We monitor task implementation through indicator reviews and regular assessment. A regional environmental regulations database tracks legislative trends in real time, allowing us to proactively assess and address compliance risks. We help employees cultivate environmental compliance capabilities through regular training and awareness campaigns, while EHS personnel receive specialized training and benchmark best practices from leading environmental businesses. These accomplishments in our environmental management practices are then published in our annual sustainability reports, ensuring transparent communication with stakeholders.

Through this proactive framework, Classys has not experienced any violations of environmental regulations, incidents, or related lawsuits to date. We remain committed to ongoing compliance and risk management in adherence to environmental laws.

Governance

Results of the 10th Annual General Shareholders’ Meeting

| Agenda Item | Result | Ratio to Total Voting Shares | Remarks | ||

| Attendance Rate |

Approval Rate | Dissent/ Abstention Rate | |||

| Agenda Item 1. Approval of the 10th Consolidated and Separate Financial Statements (Cash Dividend of KRW 257 per Share) | Approved | 75.9% | 74.8% | 1.1% | |

| Agenda Item 2. Partial Amendment to the Articles of Incorporation | Approved | 75.9% | 75.9% | 0.0% | |

| Agenda Item 3. Appointment of Shin Kyung-ja as an Outside Director | Approved | 75.9% | 75.9% | 0.0% | |

| Agenda Item 4. Appointment of Shin Kyung-ja as an Audit Committee Member | Approved | 47.3% | 99.9% | 0.1% | |

| Agenda Item 5. Approval of Remuneration Ceiling for Directors | Approved | 75.9% | 75.9% | 0.1% | |

| Agenda Item 6. Approval of Stock Option Grant by BOD Resolution | Approved | 75.9% | 75.9% | 0.1% | |

(Note 1) The number of shares with restricted voting rights under the Commercial Act was excluded.

Results of the Extraordinary General Shareholders’ Meeting on July 21, 2025

| Agenda Item | Result | Ratio to Total Voting Shares | Remarks | ||

| Attendance Rate |

Approval Rate | Dissent/ Abstention Rate | |||

| Agenda Item 1. Appointment of Rhee, Eun Ji as Non-executive Director | Approved | 71.2% | 70.4% | 0.7% | |

(Note 1) The number of shares with restricted voting rights under the Commercial Act was excluded.

Results of the Extraordinary General Shareholders’ Meeting on December 22, 2025

| Agenda Item | Result | Ratio to Total Voting Shares | Remarks | ||

| Attendance Rate |

Approval Rate |

Dissent/ Abstention Rate | |||

| Agenda Item 1. Reduction of Capital Reserve and Transfer of Retained Earnings | Approved | 69.1% | 69.1% | 0.0% | |

| Agenda Item 2. Partial Amendment to the Articles of Incorporation | Approved | 69.1% | 69.1% | 0.0% | |

(Note 1) The number of shares with restricted voting rights under the Commercial Act was excluded.

Dividend information for the last 5 years

| Category | Cash dividend per share (KRW) | Total cash dividends (KRW) | Consolidated cash dividend payout ratio (%) | Dividend yield (%) |

| 2020 | 60 | 3,882,550,080 | 10.2% | 0.4% |

| 2021 | 66 | 4,271,313,024 | 9.8% | 0.3% |

| 2022 | 116 | 7,471,451,656 | 9.9% | 0.6% |

| 2023 | 200 | 12,799,903,800 | 17.2% | 0.5% |

| 2024 | 257 | 16,833,843,352 | 17.2% | 0.5% |

Appointment and Composition of the Board of Directors

The board of directors (BOD) is responsible for determining the company’s management objectives and strategies, as well as effectively supervising management to promote growth and protect stakeholders’ interests. To fulfill these functions effectively, the BOD is organized and operated with transparency in accordance with all legal procedures. The BOD consists of directors appointed by the GSM in accordance with the Korean Commercial Act and Classys’ Articles of Incorporation. As of the end of July 2025, the BOD comprised eight directors: one executive director, four non-executive directors, and three outside directors. Information on director candidates is disclosed in detail in the notice of convocation and the electronic voting system, with final appointments confirmed at the GSM. In accordance with Article 363 of the Commercial Act and Article 21 of the Articles of Incorporation, shareholders are notified at least two weeks prior to the meeting by written or electronic notice, specifying the date, location, and agenda. When the appointment of directors is included on the agenda, candidate names, backgrounds, and relevant information are provided. Director candidates are recommended from various channels, including shareholders and stakeholders. Evaluation and selection criteria comprehensively consider diversity, expertise, and alignment with the company’s direction. Factors such as race, nationality, gender, place of origin, or religion are not limiting. Rather, independence of judgment is a key criterion. Candidates who share the company’s vision and management philosophy and can provide meaningful insights are selected. For independent directors, candidates undergo additional review and recommendation by the Nomination Committee to ensure objectivity. The committee also reviews selection criteria annually to ensure appropriateness and continuous improvement.

Careers and Term

| Name | Key Experience | Appointment date* | Term of office |

| Kim, Dong Wook Non-executive director |

BE in Electrical Engineering, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| MBA, Columbia Business School | |||

| 2006-2020 Managing Director, Citigroup Global Market Security | |||

| 2020-present Partner, Bain Capital Private Equity | |||

| 2022-present Non-executive director, CLASSYS Inc. | |||

| Kim, Hyunseung Chair of the Board & Non-executive director |

BS in Industrial Engineering, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| 2018-present Senior executive director, Bain Capital Private Equity | |||

| 2022-present Non-executive director, CLASSYS Inc. | |||

| Rhee, Eun Ji Non-executive director |

BA in Art History & Marketing, Washington University in St. Louis | 2025.07.21 | 2025.07.21 ~ 2028.03.31 |

| MBA, Harvard Business School | |||

| 2015 -2018 Associate, McKinsey & Company | |||

| 2020-2021 Private Equity Investment Professional, Permira Advisers | |||

| 2021-present Principal, Bain Capital Private Equity | |||

| 2025-present Non-executive director, CLASSYS Inc. | |||

| Park, Wan Jin Non-executive director |

BA of Economics, Stanford University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| MS of Management Science & Engineering, Stanford University | |||

| 2016-present Managing director, Bain Capital Private Equity | |||

| 2022-present Non-executive director, CLASSYS Inc. | |||

| Park, Jun Hong Outside director |

BA in Management, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| MA, Business School, Seoul National University | |||

| MBA, University of Michigan—Ann Arbor | |||

| 2017-2020 Managing director/Vice president, Johnson & Johnson, Vietnam | |||

| 2022-present Outside director, Ildong Holdings Co., Ltd | |||

| 2022-present Outside director and Audit Committee member, CLASSYS Inc. |

|||

| Kwon, Hyuk Jin Outside director & Chair of the Audit Committee |

BA in Economics, College of Social Science, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| MA in Financial Management, Business School, Seoul National University | |||

| Ph.D in Finance & Accounting, Business School, Dongguk University | |||

| 2020-2021 Director/Vice president, Jungjin Accounting Corp. | |||

| 2021-2024 Full-Time auditor, Kolon Life Science | |||

| 2021-present Adjunct Prof., Dongguk Univ. (Dept. of Accounting) | |||

| 2022-present Outside director and chair of Audit Committee, CLASSYS Inc. | |||

| Shin, Kyung-ja Outside director |

B.A./M.A. in English Lit., Ewha Womans University | 2025.03.31 | 2025.03.31 ~ 2026.03.30 |

| MBA, The Fuqua School of Business, Duke University | |||

| 2016-present Head of Marketing, Asia Pacific Platform & Device, Google | |||

| 2025-present Outside director and Audit Committee member, Classys |

* The above appointment date reflects the initial appointment date, even if reappointed.

Board Skill Matrix

| Category | Kim, Dong Wook | Kim, Hyun seung | Rhee, Eun Ji | Park, Wan Jin | Park, Jung Hong | Kwon, Hyuk Jin | Shin, Kyung-ja | |

| Committees, etc. | Audit Committee | ○ | ● | ○ | ||||

| Nomination Committee | ○ | ○ | ● | |||||

| Compensation Committee | ○ | ○ | ● | |||||

| Outside Directors Council | ● | ○ | ○ | |||||

| BSM | Medical Equipment Industry | ○ | ○ | ○ | ○ | ○ | ||

| Healthcare and Beauty Industries | ○ | ○ | ○ | ○ | ○ | |||

| Accounting and Finance | ○ | ○ | ○ | ○ | ○** | |||

| Sales and Marketing | ○ | ○ | ||||||

| Diversity | ○ | ○ | ||||||

| M&A | ○ | ○ | ○ | ○ | ||||

*●: Chair

** Certified public accountant

Activities

2024

| Date | Agenda | Result | Outside directors’ Approval/ Attendance/ Capacity |

| Feb. 14, 2024 | Report Agenda 1) Report by the CEO on the Internal Controls Operation Status over Financial Reporting Agenda 1. Approval of the 9th Financial Statements Agenda 2. Approval of the 9th Business Report Agenda 3. Approval of Bonus Payments Agenda 4. Amendment of Internal Accounting Management Regulations and Guidelines |

Reported Approved Approved Approved Approved |

3/3/3 |

| Feb. 27, 2024 | Agenda 1. Approval of the Cancellation of Treasury Stock Agenda 2. Resolution on Dividends |

Approved Approved |

3/3/3 |

| Mar. 13, 2024 | Report Agenda 1) Report on the Internal Controls Evaluation over Financial Reporting by the Audit Committee Agenda 1. Partial Amendment of Board Operating Policies Agenda 2. Cancellation of Stock Option Grant Agneda 3. Nomination of Director and Audit Committee Member Candidates Agenda 4. Convening of Regular General Shareholders’ Meeting and Submission of Agenda Agenda 5. Evaluation of the Board of Directors, Board Committees, and Individual Directors |

Reported Approved Approved Approved Approved Approved |

3/3/3 |

| Mar. 29, 2024 | Agenda 1. Appointment of CEO | Approved | 3/3/3 |

| Mar. 29, 2024 | Agenda 1. Appointment of Compensation Committee Members Agenda 2. Appointment of Nomination Committee Members Agenda 3. Selection of Lead Outside Director Agenda 4. Approval of Remuneration for Registered Directors Report Agenda 1) Report on the Evaluation of the Audit Committee’s Audit Activities Report Agenda 2) Report on Adjustments to Financial Statements Before and After Auditing |

Approved Approved Approved Approved Reported Reported |

3/3/3 |

| May 8, 2024 | Reporting Agenda 1) Q1 Financial Results Reporting Agenda 2) Business Plan Reporting Agenda 3) Anti-Corruption Plan Agenda 1. Establishment of Compliance Program guidelines Agenda 2. Appointment and Dismissal of Compliance Officer Agenda 3. ESG Materiality Assessment Results Agenda 4. ESG Management Performance Results Agenda 5. Establishment of a Local Subsidiary in Japan |

Reported Reported Reported Approved Approved Approved Approved Approved |

3/3/3 |

| June 25, 2024 | Agenda 1. Cancellation of Stock Option Grant Agenda 2. Approval of Stock Option Grant |

Approved Approved | 3/3/3 |

| June 25, 2024 | Agenda 1. Approval of Merger Agreement Agenda 2. Determining the Record Date for Shareholder |

Approved Approved | 3/3/3 |

| June 25, 2024 | Agenda 1. Approval of Special Bonus Agreement | Approved | 3/3/3 |

| Aug. 13, 2024 | Report Agenda 1) Q2 Financial Results Report Agenda 2) Compliance Program Operation Plan |

Reported Reported | 3/3/3 |

| Aug. 13, 2024 | Agenda 1. Approval of a Small-Scale Merger | Approved | 3/3/3 |

| Sep. 14, 2024 | Agenda 1. Approval of Supplemental Special Bonus Agreement Agenda 2. Approval of Supplemental Agreement on Post-Closing Adjustment for Share Purchase Agreement Agenda 3. Approval of Non-Exercise of Termination Right and Continuation of Merger |

Approved Approved Approved | 3/3/3 |

| Sep. 19, 2024 | Agenda 1. Approval of Change in GSM Date for Final Merger Report | Approved | 3/3/3 |

| Sep. 25, 2025 | Agenda 1. Approval of Loan to Ilooda Co., Ltd. | Approved | 3/3/3 |

| Sep. 25, 2025 | Agenda 1. Approval of Settlement Agreement for Damages | Approved | 3/3/3 |

| Oct. 2, 2024 | Agenda 1. Report and Disclosure of Merger Progress Report Agenda 2. Notification of Registration of Branch Office |

Approved Approved | 3/3/3 |

| Nov. 8, 2024 | Report Agenda 1) Q3 Financial Results Report Agenda 2) Succession Plan Report Agenda 3) Financial and Non-Financial Risks Activities of Chief Risk Officer Report Agenda 4) Report on Environmental and Occupational Health & Safety Management Performance Results Report Agenda 5) Evaluation of Compliance Controls and Programs Effectiveness Agenda 1. Appointment of Compliance Officer Agenda 2. Approval of Concurrent Service as Director and Auditor at Subsidiaries |

Reported Reported Reported Reported Reported Approved Approved | 3/3/3 |

| Nov. 8, 2024 | Agenda 1. Approval of Branch Office Establishment | Approved | 3/3/3 |

| Dec. 10, 2024 | Agenda 1. Approval of Treasury Stock Trust Agreement | Approved | 3/3/3 |

| Dec. 17, 2024 | Agenda 1. Approval of Additional Capital Contribution and Debt Guarantee for the Japan Subsidiary | Approved | 3/3/3 |

2023

| Date | Agenda | Result | Outside directors’ Approval/ Attendance/ Capacity |

| Feb. 15, 2023 | Report Agenda 1) Report by the CEO on the Internal Controls Operation Status over Financial Reporting Agenda 1. Approval of the 8th Financial Statements Agenda 2. Approval of the 8th Business Report Agenda 3. Approval of the Introduction of Electronic Voting Agenda 4. Approval of Bonus Payments |

Reported Approved Approved Approved Approved |

3/3/3 |

| Mar. 13, 2023 | Report Agenda 1) Report by the Audit Committee on the Internal Controls Evaluation over Financial reporting Agenda 1. Amendment of the Articles of Incorporation Agenda 2. Resolution on Dividends Agenda 3. Amendment of Stock Option Regulations Agenda 4. Granting of Stock Options Agenda 5. Convening of Regular General Shareholders’ Meeting |

Reported Approved Approved Approved Approved Approved |

3/3/3 |

| Mar. 13, 2023 | Agenda 1. Approval of the Extension of the Trust Contract for the Acquisition of Treasury Stock | Approved | 3/3/3 |

| Mar. 30, 2023 | Report Agenda 1) Report on Adjustments to Financial Statements Before and After Auditing Report Agenda 2) Report on the Audit Committee’s Evaluation of Audit Activities Agenda 1. Approval of Remuneration for Registered Directors |

Reported Reported Approved |

3/3/3 |

| Mar. 30, 2023 | Agenda 1. Granting of Stock Options | Approved | 3/3/3 |

| May. 04, 2023 | Agenda 1. Acquisition of Redeemable Convertible Preferred Stock of Another Company | Approved | 3/3/3 |

| May. 18, 2023 | Report Agenda 1) Q1 Settlement Results Report Agenda 2) ESG Strategy Report Agenda 1. Partial Amendment of Board Operating Policies Agenda 2. Selection of Lead Outside Director Agenda 3. Establishment and Appointment of Members of the Compensation Committee Agenda 4. Establishment and Appointment of Members of the Nomination Committee Agenda 5. Approval of Asset Management Plan |

Reported Reported Approved Approved Approved Approved Approved |

3/3/3 |

| Aug. 10, 2023 | Report Agenda 1) Q2 Settlement Results Agenda 1. Approval of ESG Materiality and Business Performance |

Reported Approved |

3/3/3 |

| Sep. 04, 2023 | Agenda 1. Decision to Purchase Shares Issued by Another Company Agenda 2. Approval of Extension of Trust Contract for the Acquisition of Treasury Stock |

Approved Approved |

3/3/3 |

| Nov. 07, 2023 | Report Agenda 1) Q3 Settlement Results Report Agenda 2) Succession Plan Report Agenda 3) Risk Management Activities of the Chief Risk Officer (Financial/Non-financial) Report Agenda 4) Anti-corruption Plan Implementation Results According to Classys’ Code of Ethics |

Reported Reported Reported Reported |

3/3/3 |

| Nov. 07, 2023 | Agenda 1. Approval of Termination of Trust Contract for the Acquisition of Treasury Stock | Approved | 3/3/3 |

| Dec. 20, 2023 | Agenda 1. Approval of New ERP Development Approved | Approved | 3/3/3 |

Outside Directors Council

Introduction

To strengthen the independence of outside directors in supervising and supporting executive management, Classys operates an Outside Directors Council consisting of all our outside directors. Its composition is made up solely of outside directors, excluding management, ensures free and objective discussions within the council, and promotes the company’s growth and shareholder rights.

As decided by the outside directors, Park Jun-hong, an outside director who had previously served as the head of a global pharmaceutical and healthcare subsidiary, was appointed to lead the Outside Directors Council in 2023. The council collects opinions from outside directors and communicates them to the board and/or management. Additionally, Classys supports the operation of the council by providing all the necessary resources and, if needed, covers the costs of any consulting experts.

Members

| Name | Key Experience | Appointment date* | Term of office |

| Park, Jun Hong Lead outside director |

BA in Management, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| MA, Business School, Seoul National University | |||

| MBA, University of Michigan—Ann Arbor | |||

| 2017-2020 Managing director/Vice president, Johnson & Johnson, Vietnam | |||

| 2022-present Outside director, Ildong Holdings Co., Ltd | |||

| 2022-present Outside director and Audit Committee member, CLASSYS Inc. |

|||

| Kwon, Hyuk Jin Outside director |

BA in Economics, College of Social Science, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| MA in Financial Management, Business School, Seoul National University | |||

| Ph.D in Finance & Accounting, Business School, Dongguk University | |||

| 2020-2021 Director/Vice president, Jungjin Accounting Corp. | |||

| 2021-2024 Full-Time auditor, Kolon Life Science | |||

| 2021-present Adjunct Prof., Dongguk Univ. (Dept. of Accounting) | |||

| 2022-present Outside director and chair of Audit Committee, CLASSYS Inc. | |||

| Shin, Kyung-ja Outside director |

B.A./M.A. in English Lit., Ewha Womans University | 2025.03.31 | 2025.03.31 ~ 2026.03.30 |

| MBA, The Fuqua School of Business, Duke University | |||

| 2016-present Head of Marketing, Asia Pacific Platform & Device, Google | |||

| 2025-present Outside director and Audit Committee member, Classys |

* The above appointment date reflects the initial appointment date, even if reappointed.

Activities

2024

| Date | Agenda | Result |

| Sep.25, 2024 | Agenda 1. Report and Discussion on PMI Outcomes | Approved |

2023

| Date | Agenda | Result |

| Nov.29, 2023 | Agenda 1. Discussion on the Board Evaluation Proposal | Approved |

Compensation Committee

Introduction

Classys is committed to ensuring objectivity and fairness in decisions regarding the compensation of executive directors. To that end, we have established a Compensation Committee composed exclusively of directors who have no personal or professional ties to the executive directors. This committee is tasked with aligning the executive compensation package with the company’s long-term goals and interests.

The Compensation Committee employs a holistic approach in evaluating compensation packages. This includes consideration of both short-term and long-term goals as well as a blend of financial and non-financial indicators. It conducts regular reviews and evaluations to check if compensations are appropriately made, considering both financial indicators—business performance, profitability, and stock performance—and non-financial indicators—sustainable management factors and productivity. This comprehensive evaluation guarantees that compensation for executive directors is in line with the company’s strategy and performance in both financial and non-financial areas.

Additionally, the committee reviews the balance between financial and non-financial incentives. Financial incentives include short-term performance-based bonuses and long-term performance-based rewards such as stock options, which are directly linked to pre-defined performance goals and the company’s long-term growth. Non-financial incentives include recognition of leadership, supportive work environments promoting innovation, and career growth.

The Compensation Committee and the BoD actively discuss evaluating and adjusting the compensation structure as needed. Through this approach, Classys aligns the interests of executive directors with those of the company, thus promoting sustainable long-term value creation.

Members

| Name | Key Experience | Appointment date | Term of office |

| Kwon, Hyuk Jin Outside director & Chair of the Compensation Committee |

BA in Economics, College of Social Science, Seoul National University | 2023.05.18 | 2023.05.18~ 2026.03.27 |

| MA in Financial Management, Business School, Seoul National University | |||

| Ph.D in Finance & Accounting, Business School, Dongguk University | |||

| 2020-2021 Director/Vice president, Jungjin Accounting Corp. | |||

| 2021-2024 Full-Time auditor, Kolon Life Science | |||

| 2021-present Adjunct Prof., Dongguk Univ. (Dept. of Accounting) | |||

| 2022-present Outside director and chair of Audit Committee, CLASSYS Inc. | |||

| Kim, Dong Wook Non-executive director |

BE in Electrical Engineering, Seoul National University | 2023.05.18 | 2023.05.18~ 2026.03.27 |

| MBA, Columbia Business School | |||

| 2006-2020 Managing Director, Citigroup Global Market Security | |||

| 2020-present Partner, Bain Capital Private Equity | |||

| 2022-present Non-executive director, CLASSYS Inc. | |||

| Park, Wan Jin Non-executive director |

BA of Economics, Stanford University | 2023.05.18 | 2023.05.18~ 2026.03.27 |

| MS of Management Science & Engineering, Stanford University | |||

| 2016-present Managing director, Bain Capital Private Equity | |||

| 2022-present Non-executive director, CLASSYS Inc. |

Activities

2024

| Date | Agenda | Result |

| Feb. 27, 2024 | Agenda 1. Stock Ownership Guidelines Agenda 2. Clawback Policy for Variable Compensation Agenda 3. Review of Individual Performance and Performance-based Compensation for Executive Director(s) Agenda 4. Review of Remuneration Limits for Registered Directors to be Proposed at the General Shareholders’ Meeting |

Approved Approved Approved Approved |

| Nov. 8, 2024 | Agenda 1. Appointment of Committee Chair Agenda 2. Short-Term Incentive Criteria for Executive Directors |

Approved Approved |

2023

| Date | Agenda | Result |

| Nov. 22, 2023 | Agenda 1. Criteria for Short-term Incentive Payments for Executive Director(s) | Approved |

Nomination Committee

Introduction

Classys’ Nomination Committee reviews and evaluates candidates for outside director positions. Candidates must meet the qualifications required by relevant laws and the company’s articles of incorporation, have no significant conflicts of interest with Classys, and be able to make independent management decisions and supervise management effectively. The committee selects candidates with extensive knowledge and experience in areas such as the medical device industry, healthcare and beauty, accounting and finance, sales and marketing, diversity, and M&A. It prioritizes candidates who can independently make assessments from diverse perspectives, regardless of their race, nationality, gender, region of origin, religion, or professional background.

To ensure fairness in the recommendation and appointment process of outside directors, Classys provides detailed information about candidates, including their key career achievements, relationship with the company, and reasons for the recommendation, through a shareholders’ meeting notice and reference materials.

Members

| Name | Key Experience | Appointment date | Term of office |

| Park, Jun Hong Outside director & Chair of the Nomination Committee |

BA in Management, Seoul National University | 2025.03.31 | 2025.03.31 ~ 2026.03.27 |

| MA, Business School, Seoul National University | |||

| MBA, University of Michigan—Ann Arbor | |||

| 2017-2020 Managing director/Vice president, Johnson & Johnson, Vietnam | |||

| 2022-present Outside director, Ildong Holdings Co., Ltd | |||

| 2022-present Outside director, CLASSYS Inc. | |||

| Kim, Hyunseung Non-executive director |

BS in Industrial Engineering, Seoul National University | 2023.05.18 | 2023.05.18~ 2026.03.27 |

| 2018-present Senior executive director, Bain Capital Private Equity | |||

| 2022-present Non-executive director, CLASSYS Inc. | |||

| Rhee, Eun Ji Non-executive director |

BA in Art History & Marketing, Washington University in St. Louis | 2025.12.22 | 2025.12.22 ~2028.03.31 |

| MBA, Harvard Business School | |||

| 2015-2018 Associate, McKinsey & Company | |||

| 2020-2021 Private Equity Investment Professional, Permira Advisers | |||

| 2021-present Principal, Bain Capital Private Equity | |||

| 2025-present Non-executive director, CLASSYS Inc. |

Activities

2024

| Date | Agenda | Result |

| Mar. 12, 2024 | Agenda 1. Recommendation of Outside Director Candidates | Approved |

| Nov. 8, 2024 | Agenda 1. Appointment of Committee Chair Agenda 2. Establishment of Criteria for Selecting Outside Director Candidates |

Approved Approved |

2023

| Date | Agenda | Result |

| Nov. 29, 2023 | Agenda 1. Establishment of Criteria for Selecting Outside Director Candidates | Approved |

Introduction

Members of the Audit Committee are appointed at the general shareholders’ meeting, with due consideration given to legal requirements and independence. The Audit Committee is composed of individuals with expertise in accounting, finance, and relevant industry knowledge, and who are free from any material interests with the company or its management, thereby ensuring independence in their supervisory role.

The committee reviews and oversees key management activities, including financial audits and evaluations of the internal accounting control system. It also monitors the operation of internal control mechanisms and deliberates on matters submitted to the general shareholders’ meeting, as well as other duties specified in the Articles of Incorporation. The Audit Committee discusses agenda items such as internal accounting controls and internal audit results, maintaining regular communication with external auditors.

Classys provides the Audit Committee with the necessary management data to perform its duties and regularly shares updates on key corporate matters to support the committee’s oversight. To enhance members’ understanding of the business and maintain their auditing expertise, the company also conducts regular training sessions.

Members

| Name | Key Experience | Appointment date* | Term of office |

| Park, Jun Hong Lead Outside director |

BA in Management, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| MA, Business School, Seoul National University | |||

| MBA, University of Michigan—Ann Arbor | |||

| 2017-2020 Managing director/Vice president, Johnson & Johnson, Vietnam | |||

| 2022-present Outside director, Ildong Holdings Co., Ltd | |||

| 2022-present Outside director and Audit Committee member, CLASSYS Inc. | |||

| Kwon, Hyuk Jin Outside director & Chair of the Audit Committee |

BA in Economics, College of Social Science, Seoul National University | 2022.03.31 | 2022.03.31 ~ 2026.03.27 |

| MA in Financial Management, Business School, Seoul National University | |||

| Ph.D in Finance & Accounting, Business School, Dongguk University | |||

| 2020-2021 Director/Vice president, Jungjin Accounting Corp. | |||

| 2021-2024 Full-Time auditor, Kolon Life Science | |||

| 2021-present Adjunct Prof., Dongguk Univ. (Dept. of Accounting) | |||

| 2022-present Outside director and chair of Audit Committee, CLASSYS Inc. | |||

| Shin, Kyung-ja Outside director |

B.A./M.A. in English Lit., Ewha Womans University | 2025.03.31 | 2025.03.31 ~ 2026.03.30 |

| MBA, The Fuqua School of Business, Duke University | |||

| 2016-present Head of Marketing, Asia Pacific Platform & Device, Google | |||

| 2025-present Outside director and Audit Committee member, Classys |

* The above appointment date reflects the initial appointment date, even if reappointed.

Activities

2024

| Date | Agenda | Result |

| Feb. 14, 2024 | Report Agenda 1) Final Report on Internal Accounting Controls Report Agenda 2) In-Person Report by the CEO on the Internal Controls Operation Status over Financial Reporting Report Agenda 3) Report on the Financial Statements Settlement and the Business Report Report Agenda 4) Report on External Audit Contract Conclusion Report Agenda 5) Report on Internal Audit Results Report Agenda 6) Report on the Operation Status of the Internal Reporting System Report Agenda 7) Report on the Status of Disclosure Compliance Agenda 1. Evaluation of the Internal Controls Operation Status over Financial Reporting Agenda 2. Revisions to the Internal Control over Financial Reporting Regulations and Guidelines |

Reported Reported Reported Reported Reported Reported Reported Approved Approved |

| Mar. 13, 2024 | Agenda 1. Review of Agenda Items for the Regular General Shareholders’ Meeting Agenda 2. Evaluation of the Effectiveness of the Audit Committee, Its support Team, and Internal Accounting Control System Agenda 3. Approval of the Audit Report and Auditors’ Opinion |

Approved Approved Approved |

| Mar. 18, 2024 | Report Agenda 1) Communication with the External Auditors | Approved |

| Mar. 29, 2024 | Agenda 1. Appointment of the Audit Committee Chair and Designation of the Order of Acting Chair in Case of Vacancy Agenda 2. Appointment and Dismissal of the Audit Committee Support Team Agenda 3. Post-evaluation of the External Auditors Agenda 4. Approval of Annual Plans for the Audit Committee, Internal Audits, and Internal Control over Financial Reporting |

Approved Approved Approved Approved |

| May 8, 2024 | Report Agenda 1) Q1 Financial Results Report Agenda 2) Interim Report on Internal Accounting Report Agenda 3) Operational Status of the Whistleblower System Report Agenda 4) Disclosure Compliance Report |

Reported Reported Reported Reported |

| May 29, 2024 | Report Agenda 1) Communication with External Auditor | Reported |

| Aug. 13, 2024 | Report Agenda 1) Communication with External Auditor Report Agenda 2) Q2 Financial Results Report Agenda 3) Interim Report on Internal Accounting Report Agenda 4) Outcome of Amendments to Accounting Guidelines for Tangible and Intangible Assets Report Agenda 5) Internal Audit Results Report Agenda 6) Operational Status of the Whistleblower System Report Agenda 7) Disclosure Compliance Report |

Reported Reported Reported Reported Reported Reported Reported |

| Nov. 8, 2024 | Report Agenda 1) Q3 Financial Results Report Agenda 2) Interim Report on Internal Accounting Report Agenda 3) Operational Status of the Whistleblower System Report Agenda 4) Report on the Status of Disclosure Compliance Report Agenda 5) Ad Hoc Internal Audit Results |

Reported Reported Reported Reported Reported |

| Dec. 17, 2024 | Report Agenda 1) Communication with the External Auditor | Reported |

2023

| Date | Agenda | Result/td> |

| Feb. 15, 2023 | Report Agenda 1) Final Report on Internal Controls over Financial Reporting Report Agenda 2) In-person Report by the CEO on the Internal Controls Operation Status over Financial Reporting Report Agenda 3) Report on the Business Report and Financial Statements Settlement Report Agenda 4) Report on External Audit Contract Conclusion Report Agenda 5) Report on Internal Audit Results Report Agenda 6) Operation Status of the Whistleblower System Report Agenda 7) Report on the Status of Disclosure Compliance Agenda 1. Evaluation of the Internal Controls Operation Status over Financial Reporting |

(Report) (Report)(Report) (Report) (Report) (Report) (Report) Approved |

| Mar. 22, 2023 | Report Agenda 1) Communication with the External Auditors Agenda 1. Review of Agenda Items for the Regular General Shareholders’ Meeting Agenda 2. Evaluation of Audit Activities Agenda 3. Approval of the Audit Report and Audit Committee’s Opinion |

(Report) Approved Approved Approved |

| Mar. 30, 2023 | Agenda 1. Post-evaluation of the External Auditor Agenda 2. Approval of Three Agenda Items, Including the Audit Committee’s Operational Plan Agenda 3. Appointment and Dismissal of the Audit Committee Support Team |

Approved Approved Approved |

| May 18, 2023 | Report Agenda 1) Q1 Settlement Results Report Agenda 2) Interim Report on Internal Accounting Controls Report Agenda 3) Report on the Evaluation of the Qualifications of Internal Accounting Control Personnel Report Agenda 4) Operational Status of the Whistleblower System Report Agenda 5) Report on the Status of Disclosure Compliance Report Agenda 6) Communication with the External Auditor |

(Report) (Report) (Report) (Report) (Report) (Report) |

| Aug. 10, 2023 | Report Agenda 1) Q2 Settlement Results Report Agenda 2) Interim Report on Internal Accounting Controls Report Agenda 3) Internal Audit Results Report Agenda 4) Operational Status of the Whistleblower System Report Agenda 5) Report on the Status of Disclosure Compliance Report Agenda 6) Communication with the External Auditor Report Agenda 7) Report on the Enactment and Revision of Four Items, Including Accounting Regulations Agenda 1. Approval of Partial Revisions to the Audit Committee Policy and Whistleblower Policy |

(Report) (Report) (Report) (Report) (Report) (Report) (Report) Approved |

| Nov. 07, 2023 | Report Agenda 1) Q3 Settlement Results Report Agenda 2) Interim Report on Internal Accounting Controls Report Agenda 3) Operational Status of the Whistleblower System Report Agenda 4) Report on the Status of Disclosure Compliance Report Agenda 5) Communication with the External Auditor |

(Report) (Report) (Report) (Report) (Report) |

Policies to ensure independence and expertise when appointing external auditor

For the appointment of an external auditor, the Audit Committee reviews proposals of firms and assesses candidates and approves the agenda item to appoint an external in accordance with the Act on External Audit of Stock Companies and a regulation regarding the appointment of an external auditor. Based on the approval of the Audit Committee, an external auditing contract is signed with external auditors. The Company consults with external auditors to determine the audit time, capacity, fees, and plan, ensuring the auditor’s independence. Also, the Audit Committee evaluates after the conclusion of the external audit whether the external auditor has fulfilled its duties and whether the content and frequency of communications were appropriate.

Status of External Auditor Appointment

In accordance with Article 12① of the Act on External Audit of Stock Companies and Article 18① of its Enforcement Decree, Classys has entered into a three-year external audit contract with Ernst & Young Hanyoung for the fiscal years 2025 through 2027.

| Name | Appointment | Term | Remark |

| Ernst & Young Hanyoung Accounting Corporation | Feb.06.2025 | FY2025 ~ FY2027 |

Status of Non-Audit Services with the External Auditor

Classys has not entered into any non-audit service agreements with Ernst & Young Hanyoung, its external auditor. In the event that such an agreement is considered, the company evaluates whether the engagement may impair the auditor’s independence or audit quality and proceeds only after obtaining approval from the Audit Committee.

Compliance

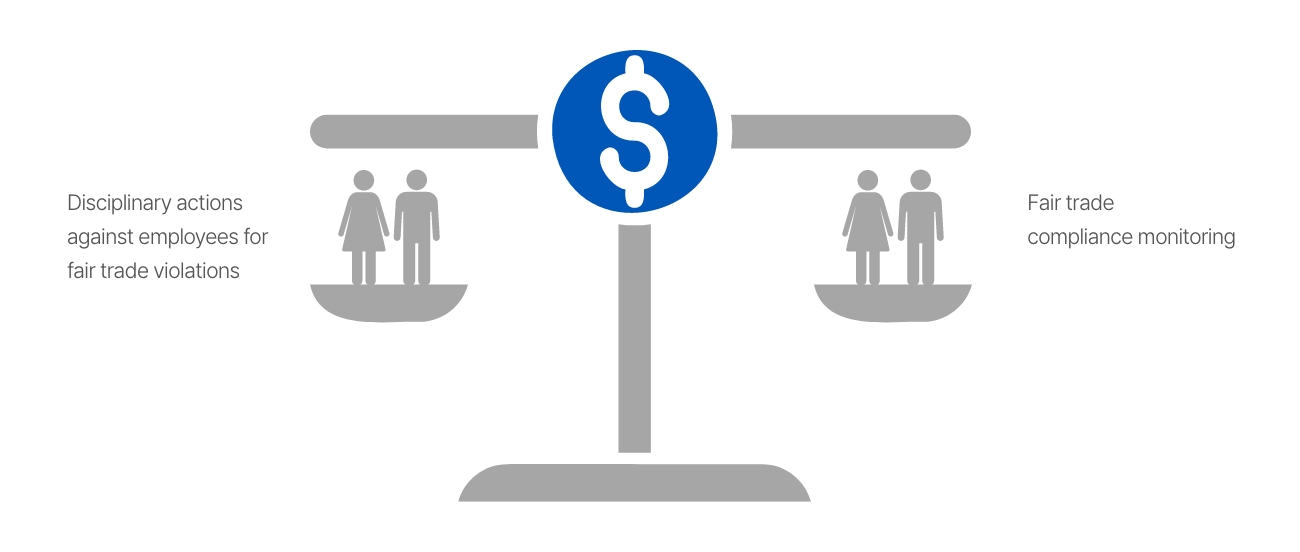

Compliance Program?

Compliance Program(CP) is a system and code of conduct which is introduced and operated by companies to comply with the laws and regulations related to fair trade. The core part of CP is an establishment of a system that prevents risks that accompany violation of laws and regulations related to fair trade and development of the code of conduct.

CLASSYS Anti-Corruption Policy

CLASSYS, which strives to become a global company based on creative and challenge spirit for its management philosophy of "Respect for Human Life" and "Value Creation" hereby declares an anti-corruption policy to prevent corruption in order to strengthen compliance management. All employees must be fully aware of and comply with the anti-corruption policy.

-

- All corrupt practices including bribery are prohibited.

-

- All employees must strictly comply with all laws and internal regulations to prevent corruption.

-

- All perceived acts of corruption and potential for corruption shall be informed withou delay.

-

- All shall maintain and enhance personal dignity and company’s honor by practicing anti-corruption policies.

To prevent corruption, CLASSYS will strive to ahieve “Anti-Corruption Management Goals” by implementing “Anti-Corruption Policy” on all employees, under the direction of “Compliance Officer” who has independent authority to prevent corruption. CLASSYS will also do its best to continuously improve the anti-corruption management system. CEO of CLASSYS SH Beak

- 01

-

- CEO’s Declaration of Commitment to Compliance

- Reporting of key program operation details to the CEO

- Designation of a Compliance Officer, establishment and operation of a compliance management organization

- Creation and distribution of compliance manuals and guidelines

- 02

-

- Employee training programs

- Prior consultation system for fair trade

- Monitoring of compliance with fair trade regulations

- Fair trade compliance pledge

- 03

-

- Fair trade-related incentives and employee sanctions for violating fair trade laws

- Internal reporting system

| Date | Event | Description |

| Aug 2023 | Fair Trade Compliance Manual Creation | Developed the initial compliance manual. |

| Mar 2024 | Internal Report on Compliance Program Adoption | Provided an internal update on the progress of implementing the compliance program. |

| May 2024 | Appointment of Compliance Officer | Appointed a Compliance Officer to oversee the program. |

| May 2024 | Establishment of Compliance Standards | Developed specific standards and guidelines for compliance. |

| May 2024 | Creation of Compliance Portal | Launched an online platform for compliance-related information and resources. |

| Aug 2024 | Establishment of Compliance Operating Regulations | Formalized the operational procedures for the compliance program. |

| Aug 2024 | Creation of Compliance Guides and Checklists | Developed detailed guides and checklists to assist employees in complying with regulations. |

| Aug 2024 | Revision of Compliance Manual | Updated the compliance manual to reflect recent changes and developments. |

| Aug 2024 | Board Report on Compliance Program Status | Provided an update to the board on the progress and effectiveness of the compliance program. |

| Aug 2023 – Present | CEO’s Declaration of Commitment to Compliance | The CEO has consistently expressed their commitment to compliance. |

| Aug 2023 – Present | Employee Compliance Training | Ongoing training programs to educate employees about compliance requirements. |

| Aug 2023 – Present | Distribution of Compliance Newsletter | Regular dissemination of compliance-related news and updates. |

We would like to express our sincere gratitude to all of our partners for their various forms of cooperation. This ‘Partner Compliance’ program is designed to foster a mutually beneficial compliance partnership with your company.

Agreement on Classys Compliance Code of Conduct (English)

We/I pledge to abide by the following regarding Classys Compliance Code of Conduct and responsibilities in relation to transactions with CLASSYS.

1. We/I promise not to violate the relevant laws and regulations in conducting transactions with CLASSYS especially following laws.

– Bribery and anti-corruption laws

– Anti-money laundering and anti-terrorist financing

– Competition laws

– Global foreign trade laws and economic sanctions

2. We/I comply with the Classys Business Partner Code of Conduct.

3. In the event of an unethical act, we/I will accept any disadvantages such as termination of the contract or suspension of transactions, and we/I will not raise any civil or criminal objections in relation to your company’s disadvantageous disposition.

Classys Business Partner Code of Conduct

– We/I respect for human rights.

– We/I comply with healthy and safety laws.

– We/I comply with environmental laws.

– We/I with anti-corruption laws, anti-money laundering and terrorist financing laws, competition laws and global trade sanctions laws.

– Partners must not disclose or improperly use confidential information obtained from transactions with the CLASSYS and must comply with laws related to personal information protection.

– Partners are responsible for marketing, quality, and safety of product.

Social

Sustainable Growth and Mutual Growth

CLASSYS is seeking talented people who can grow sustainably together, driven by customer-oriented values.

We provide diverse opportunities for shared growth.

Growth for Our Sustainable Future

diversity

education

education

programs

programs

evaluations

Embracing Diversity and Creating a Welcoming Work Environment

CLASSYS believes in providing equal opportunities during talent recruitment and has implemented various programs to foster a harmonious work-life balance.

development

(up to KRW 1,000,000 per year)

(between 8 am to 10 am)

dinner provided

in-house club activities

holiday bonuses

and lounges

check-ups

postnatal leave

vacation allowances

paid time off

Allowance

A MOEL-designated Best Job-Creation Company

Health, Safety, and Information Security

CLASSYS employs secure and transparent management practices to prevent disasters and incidents.

Quality Management

CLASSYS has implemented a robust quality management system and

processes to ensure the production of highly reliable and top-quality products.

Practice (GMP) certification from the

Ministry of Food and Drug Safety (MFDS)

for our production and quality management

of medical devices

a quality management system

in the medical device industry

authorities such as the Ministry of

Food and Drug Safety Administration and

CE certification

Our Quality Management System and ISO 13485 Certification

End-to-End Quality Management Process

– Ensuring product safety and efficacy through multidimensional testing, including material properties, usability, and environmental adaptability

– Driving continuous quality improvements across the supply chain based on a CAPA (Corrective and Preventive Action) system

– Applying preventive quality management methodologies to ensure consistent product quality and prevent recurrence of quality issues

– Ensuring quality throughout the distribution process through dealer and user training

– Collecting and incorporating customer feedback to implement user centered quality improvements

– Continuously improving product quality through data-driven analysis and actions